„Our clients deserve the best advisory product available“

Our Experience and Commitment are the Key Success Factors

In addition, our clients are able to benefit from our unique insight into the strategies of a wide array of industries resulting from our ongoing strategic dialogues. In contrast to many other market participants we strongly believe that our clients recognise the benefit of a maximum of senior level attention. This is why our partners commit themselves to the daily execution of our projects.

Discrete and Impartial Advisory Concept

We respect the paramount importance of the transactions we are working on in the interest of our clients and handle all assignments with extreme care and confidentiality.

Leader in German Midmarket Transactions

Over the years, FERBER & CO. has concluded more than 300 transactions involving enterprise values of more than Euro 10 bn. Focusing on the sectors covered by us we are having consistent exposure to all major transactions leading to superior insights as well as the successful execution of up to 10 transactions per year.

Broad Range of Custom-tailored Services

It is our goal to offer unmatchable market access, a sound analysis and to provide a farsighted process implementation.

We believe that M&A advice needs to be customized and tailored to the specific needs of our clients. Therefore, we offer our clients a complete range of solutions dedicated to specific situations.

- Sell-Side Assignments and Divestitures

- Buy-Side Advisory and Target Selection

- Mergers, Alliances and Joint Ventures

- Leveraged Buy-Outs, Management Buy-Outs (MBO) and Buy-Ins (MBI)

- Public Takeover Bids

- Public to Private (P2P) Transactions

- Private Placements

- Fundraisings

- Valuations / Fairness Opinion

Ferber & Co is experienced in supporting its clients in a wide range of situations whether they be public or private, broad process driven or bilateral in nature.

Our firm is flexible enough to contribute discreetly in a highly focused fashion or run full execution driven auction type processes.

As an integral element of our advisory practice, we offer our clients high quality advice regarding the structuring of debt and equity offerings, recapitalisations, as well as the sale of debt instruments.

- Raising of Equity and Expansion Capital

- Acquisition Finance Structuring

- Stapled Financing

Our Team delivers creative solutions from a wide range of financing sources for family-owned companies, corporates or private equity firms. Our independent advisory concept enables us to impartially examine the range of all possible structures and alternatives from various sources whether they be banks or other institutional lenders or funds, including senior and junior debt as well as mezzanine structures and select the best solution for our clients.

Ferber & Co helps corporates, administrators and investors to purchase and to divest medium sized companies in special situations. We also provide advice on the right turnaround and restructuring strategy, find alternative funding, and restructure the financial structure of distressed companies.

Our Team offers experienced and credible advice based on our substantial transaction expertise without conflicts of interest:

- Distressed M&A

- Turnaround strategy

- Financial restructuring

Sell-Side

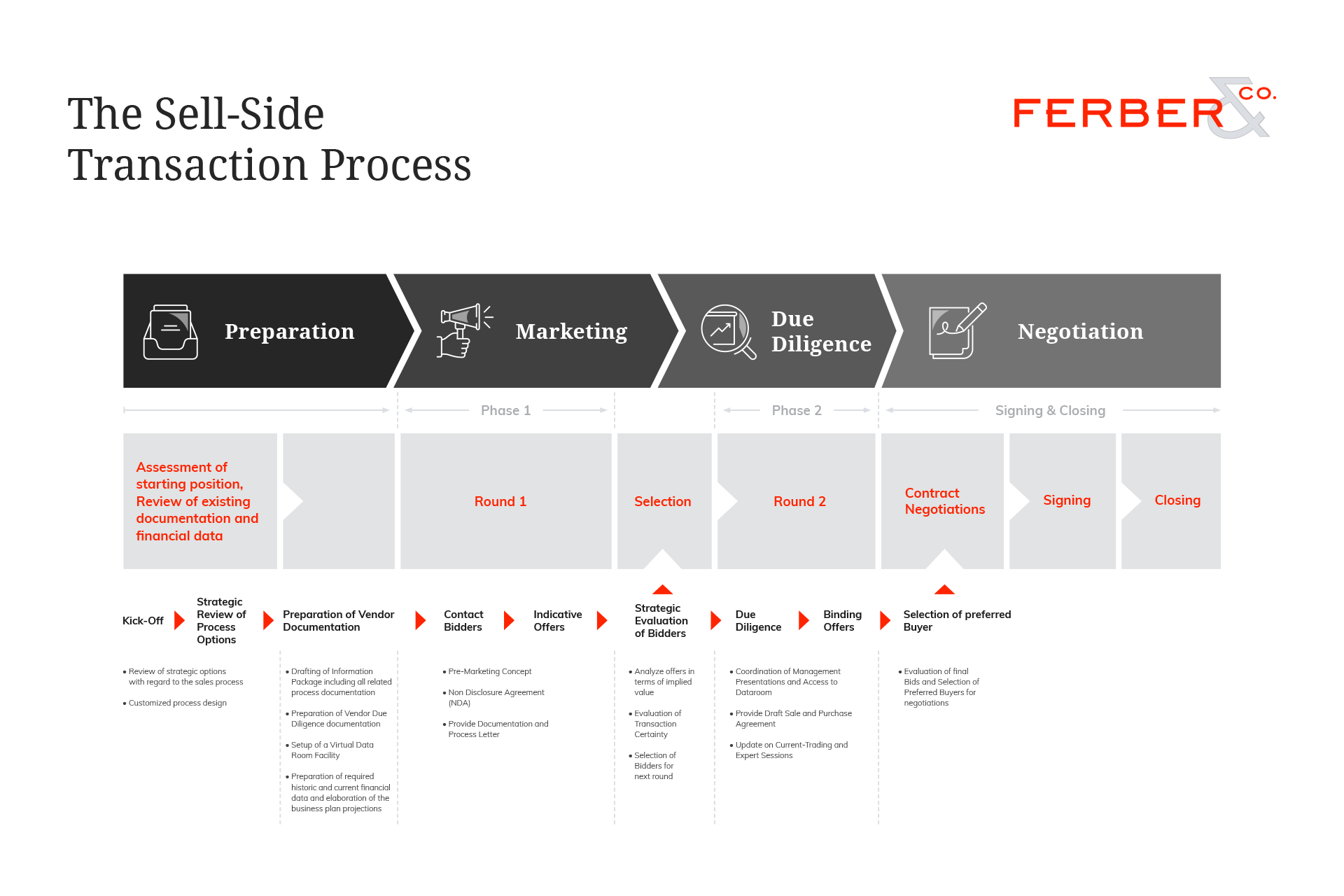

The sale of a business is a demanding transaction with far reaching consequences for all parties involved including the shareholders as well as the senior management and the employees. Hence, several elements must be considered and therefore, a comprehensive and professional execution process is required. For the owners, the sale of a company is in most cases a unique event with considerable financial and non-financial consequences. Any error in the process is difficult to readjust and costly to the owners in terms of reduced proceeds. It is a contradiction to build-up, grow and manage a business professionally over the years to sell it carelessly at a later stage. Therefore, the entire sale process must be prepared with utmost care and diligence being concluded with the ideal partner at a superior valuation as quickly and discretely as possible. We have the know-how, network and the track record to professionally arrange the sale of any company to ensure that our clients accomplish their goals:

- Identifying the right buyer

- Discrete execution of the process

- Achievement of maximum transaction certainty

- Securing the optimal purchase price and optimization of further contractual conditions

- Getting the deal done

Every potential buyer should have a clear view of the business to be acquired. Hence, a comprehensive vendor information package is the essential base for potential buyers in evaluating their interest. From a Buyer’s perspective the Information Package should contain the key information on the business, its products and markets as well as its operations including key historic and projected financials. The documentation should enable any buyer to form a view on the equity story and the strategic rationale behind the contemplated acquisition. A compelling equity story provided by the Seller is the key to any successful sale process boosting buyer’s interest and securing attractive market valuations.

Our international network and existing contacts from previous transactions allows for a comprehensive search of potential buyers, particularly in Europe, the US and Asia unlocking attractive pockets of demand for our clients. Cross-border M&A transactions involving overseas trade buyers have been constantly growing compared to previous decades. With the critical importance of financial investors in today’s market environment it is key for Sellers to attract the interest of international private equity funds and family investment vehicles increasing competition substantially.

Due diligence is a decisive instrument for buyers to assess any previous assumptions regarding the business to be acquired in order to feel more comfortable. The relevant tool for performing due diligence is the data room which includes all relevant legal, financial and tax information. The data room will be prepared by the Seller and the management and needs to be collected at a very early stage. In addition to the information contained in the data room, Sellers often commission specific financial, tax, legal and commercial due diligence reports themselves prior to potential transactions in order to speed up the due diligence process. The quality of the data room and the additional vendor due diligence reports is crucial for a successful completion of the due diligence phase and affects the valuation and the terms and conditions included in the contract.

At this stage, the major objective is to identify the best and most interested buyer(s) among the interested parties. Therefore, the routine and experience of an M&A advisor are of significant importance. Following the selection of a preferred buyer (or more buyers), the final contract negotiations are completed swiftly. FERBER & CO. serves as direct contact and negotiation partner during this stage, manages the negotiations and assists the management during this stage of the process.

As soon as the purchase price and the major conditions have been generally agreed upon with one of the potential buyers, negotiations have to be finalized. At this stage, we also coordinate the activities of our client´s advisors, particularly tax advisors, auditors and lawyers.

Buy-Side Advisory

FERBER & CO. is specialised in advising family-owned companies, international corporations and financial investors, helping them acquire targeted businesses and to strategically search for prospective targets including also add-on acquisitions to existing platforms.

Once it has been decided that an acquisition is the best way to enhance shareholder value, the crucial step is to identify a suitable target that will help our client to achieve its objectives. These usually consist of a combination of increasing market share, generating cost savings, enhancing distribution channels, diversifying products or services, and creating and exploiting cross-selling opportunities.

Subject to the individual requirements of our clients, we support buy-side processes with the following key elements:

- Definition of transaction rationale, market analysis and identification of the targets

- Analysis of targeted businesses and performance of an initial valuation

- Identification of decision makers and making the approach

- First contact and gathering of information

- Structuring the deal

- Preparation and formulation of a bid

- Negotiating and agreeing upon the heads of terms

- Conducting due diligence

- Contract negotiations

- Completing the deal

Management Buyouts (MBO/MBI)

The success of a business mostly depends on the outstanding commitment of the senior management who, in many cases, is not a shareholder. Since the management is familiar with the specifics of their business, they are in an excellent position to acquire it when it comes for sale.

Although management teams have unmatchable expertise in running companies, they usually lack the transactional expertise and financial know-how to execute the acquisition of their business. Particularly, the financial structuring and negotiation of such a transaction requires considerable experience.

Over the history of our firm we have collected ample expertise in advising management teams on buyout transactions. Our specific advisory services dedicated to entrepreneurial oriented managers involve the following activities:

- Structuring of the entire transaction in close cooperation with tax advisors, auditors and legal advisors

- Supporting the negotiations with the sellers

- Supporting the management in raising the required equity and debt financing

- Securing senior debt financing as well as mezzanine capital